The 2-Minute Rule for The Wallace Insurance Agency

Wiki Article

Fascination About The Wallace Insurance Agency

Table of ContentsThe Wallace Insurance Agency for DummiesA Biased View of The Wallace Insurance AgencyThe Wallace Insurance Agency Fundamentals ExplainedGetting The The Wallace Insurance Agency To Work8 Simple Techniques For The Wallace Insurance AgencyA Biased View of The Wallace Insurance AgencyExcitement About The Wallace Insurance AgencyWhat Does The Wallace Insurance Agency Mean?

These plans likewise supply some security aspect, to help ensure that your recipient obtains monetary settlement should the regrettable take place throughout the tenure of the plan. Where should you begin? The simplest means is to begin thinking of your concerns and requirements in life. Below are some questions to get you began: Are you searching for greater hospitalisation insurance coverage? Are you focused on your household's wellness? Are you attempting to save a good amount for your youngster's education and learning needs? Most people begin with one of these:: Versus a history of rising medical and hospitalisation expenses, you may desire bigger, and greater insurance coverage for medical expenses.: This is for the times when you're injured. As an example, ankle joint strains, back sprains, or if you're torn down by a rogue e-scooter biker. There are likewise kid-specific policies that cover play ground injuries and conditions such as Hand, Foot and Mouth Disease (HFMD).: Whole Life insurance policy covers you forever, or typically up to age 99. https://www.merchantcircle.com/blogs/the-wallace-insurance-agency-meridian-id/2023/11/The-Ultimate-Guide-to-Insurance-Coverage/2593321.

The 45-Second Trick For The Wallace Insurance Agency

Relying on your coverage strategy, you obtain a round figure pay-out if you are completely impaired or critically ill, or your liked ones obtain it if you pass away.: Term insurance coverage gives coverage for a pre-set period of time, e - Liability insurance. g. 10, 15, 20 years. Since of the much shorter insurance coverage duration and the absence of cash value, premiums are typically lower than life strategiesWhen it develops, you will receive a swelling amount pay-out. Cash for your retired life or kids's education, check. There are 4 common types of endowment plans:: A plan that lasts regarding ten years, and supplies annual money benefits on top of a lump-sum amount when it develops. It normally consists of insurance coverage against Total and Permanent Impairment, and death.

The The Wallace Insurance Agency Statements

You can select to time the payout at the age when your child mosts likely to university.: This offers you with a monthly revenue when you retire, typically in addition to insurance coverage coverage.: This is a way of conserving for short-term goals or to make your money job harder against the pressures of inflation.

Getting My The Wallace Insurance Agency To Work

While obtaining different plans will provide you more detailed coverage, being excessively protected isn't a good idea either. To stay clear of undesirable financial stress and anxiety, compare the plans that you have versus this checklist (Auto insurance). And if you're still unclear about what you'll need, just how much, or the sort of insurance policy to get, seek advice from a financial advisorInsurance policy is a long-term commitment. Constantly be sensible when choosing on a strategy, as changing or terminating a strategy too soon normally does not generate monetary advantages. Conversation with our Wealth Planning Manager now (This conversation solution is readily available from 9am to 6pm on Mon to Fri, excluding Public Holidays.) You may also leave your get in touch with details and we will certainly obtain in touch quickly.

The Greatest Guide To The Wallace Insurance Agency

The very best component is, it's fuss-free we automatically function out your cash streams and offer money pointers. This post is indicated for info only and needs to not be trusted as monetary guidance. Before making any kind of decision to buy, market or hold any type of investment or insurance policy item, you need to consult from an economic advisor concerning its viability.Invest just if you understand and can special info check your investment. Expand your investments and stay clear of investing a large part of your money in a single item company.

The Single Strategy To Use For The Wallace Insurance Agency

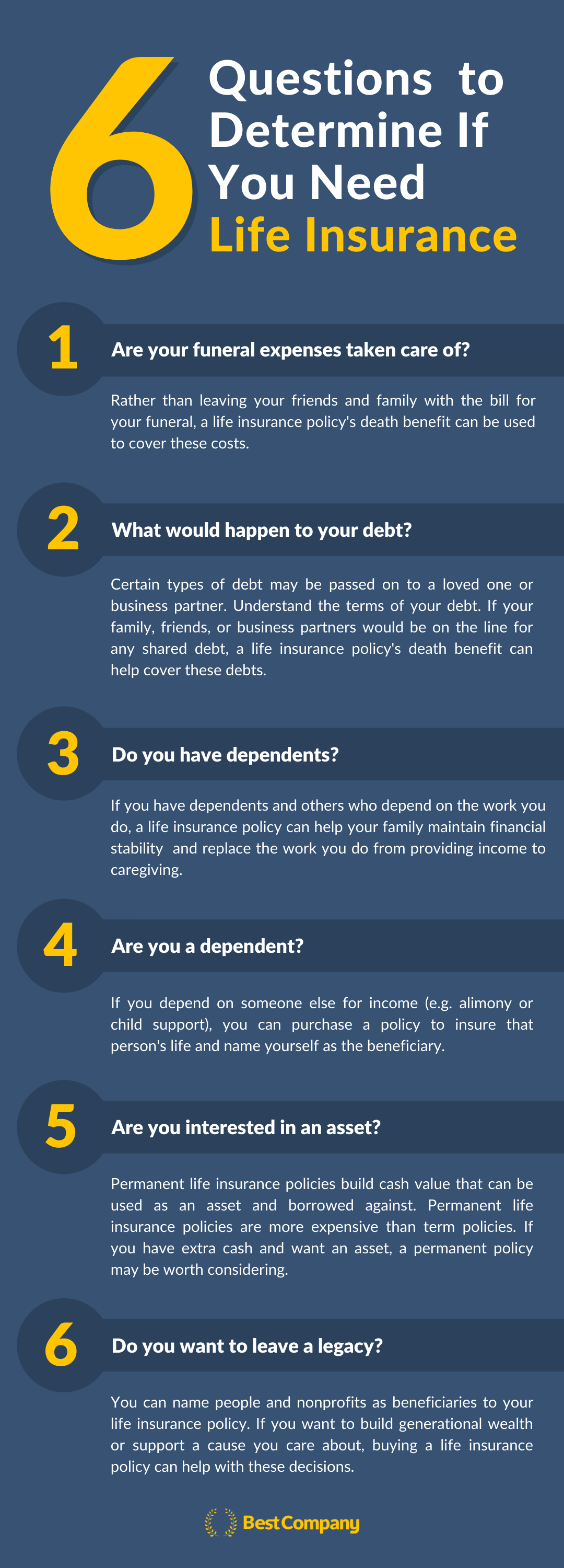

Life insurance is not constantly one of the most comfortable based on go over. Just like home and car insurance policy, life insurance policy is important to you and your household's economic security. Parents and working grownups commonly require a kind of life insurance policy policy. To assist, allow's discover life insurance policy in extra information, exactly how it functions, what worth it could supply to you, and just how Financial institution Midwest can aid you locate the right policy.

It will certainly assist your family members repay financial debt, obtain revenue, and get to significant monetary objectives (like college tuition) in the event you're not here. A life insurance policy is basic to planning these monetary considerations. In exchange for paying a monthly premium, you can obtain a collection quantity of insurance coverage.

The Wallace Insurance Agency - The Facts

Life insurance policy is best for virtually everybody, even if you're young. People in their 20s, 30s and also 40s often forget life insurance policy - https://experiment.com/users/wallaceagency1. For one, it calls for dealing with an awkward question. Lots of more youthful individuals also believe a plan merely isn't right for them provided their age and household scenarios. Opening up a policy when you're young and healthy and balanced might be a smart choice.The even more time it requires to open up a plan, the even more danger you deal with that an unanticipated occasion can leave your family members without coverage or financial help. Depending on where you're at in your life, it is essential to understand precisely which sort of life insurance policy is finest for you or if you need any whatsoever.

The Wallace Insurance Agency Can Be Fun For Everyone

As an example, a home owner with 25 years continuing to be on their mortgage could take out a policy of the same length. Or allow's state you're 30 and strategy to have youngsters quickly. Because instance, enrolling in a 30-year plan would certainly secure your costs for the following thirty years.

Report this wiki page